Tax Refund Changes 2024

Tax Refund Changes 2024. Page last reviewed or updated: As of february 16, the average tax refund is $3,207, the irs said in its latest tax season update.

You can receive $3,000 for one qualifying person, and $6,000 for two or more qualifying. See your personalized refund date as soon as the irs processes your.

That's 2.1% Higher Than The Same Period A Year Ago.

As of february 16, the average tax refund is $3,207, the irs said in its latest tax season update.

We Are Here To Break Down The Key Tax Law Changes And What You Need To Know To Help You Understand The Impacts To Your Taxes And Guide You As You Get Ready.

Let’s dive deeper into why tax refunds in 2024 may change.

Page Last Reviewed Or Updated:

Images References :

Source: moneysavvyliving.com

Source: moneysavvyliving.com

Tips to get a Bigger Tax Refund this Year Money Savvy Living, See your personalized refund date as soon as the irs processes your. The 2024 amounts increase to $23,000 for 401(k)s, 403(b)s, and 457.

Source: www.usatoday.com

Source: www.usatoday.com

Taxes 2019 Why is my refund smaller this year?, October 20, 2022 · 3 min read. Irs says tax refund is 29% lower.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

Here's the No. 1 Thing Americans Do With Their Tax Refund GOBankingRates, If you're a taxpayer, you will be paying less tax from july. Time you can claim a credit or refund.

Source: v-s.mobi

Source: v-s.mobi

Download IRS TAX REFUND 2023 IRS REFUND CALENDAR 2023 ? EITC, CTC, There were also more than 18 million refunds processed, and canadians who had a tax refund received an average of $2,262! The new law would also fix an issue that limits the ctc for some poor families:

Source: www.commoncentslifestyle.com

Source: www.commoncentslifestyle.com

Tax Changes You Need To Know Common Cents Lifestyle, The five major 2024 tax changes cover income tax brackets, the standard deduction, retirement contribution limits, the gift tax exclusion and. The following rules apply for 2023 (which will reflect on your 2024 tax return):

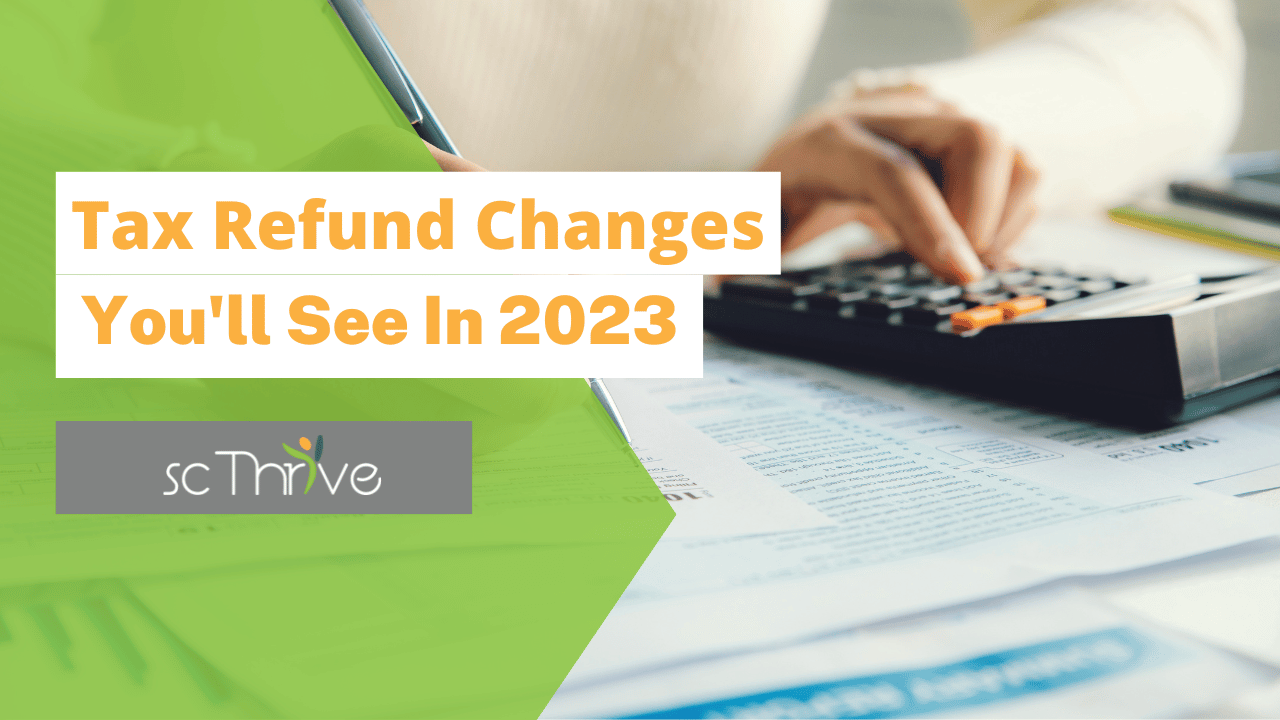

Source: scthrive.org

Source: scthrive.org

Tax Refund Changes You’ll See in 2023 SC Thrive, By comparison, the typical refund check jumped. October 20, 2022 · 3 min read.

Source: robergtaxsolutions.com

Source: robergtaxsolutions.com

refund, The new law would also fix an issue that limits the ctc for some poor families: By comparison, the typical refund check jumped.

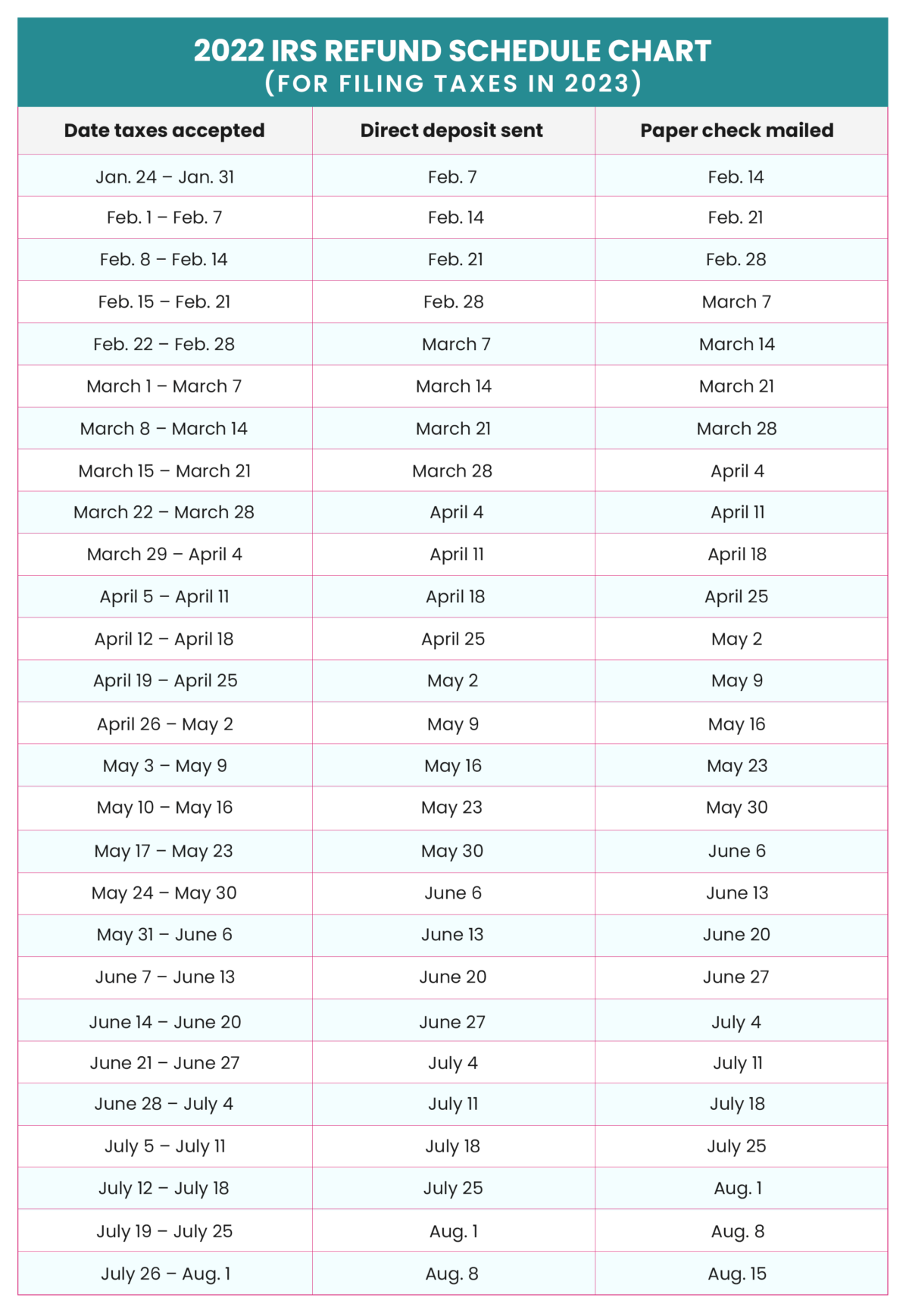

Source: printableformsfree.com

Source: printableformsfree.com

2023 Tax Refund Date Chart Printable Forms Free Online, Let’s dive deeper into why tax refunds in 2024 may change. The 15% tax rate is for filers with taxable incomes between the 0% and 20%.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, That's 2.1% higher than the same period a year ago. The five major 2024 tax changes cover income tax brackets, the standard deduction, retirement contribution limits, the gift tax exclusion and.

Source: igotmyrefund.com

Source: igotmyrefund.com

IRS efile Refund Cycle Chart for 2023, Big irs tax changes to know before you file. Additionally, roth ira contribution limits are now based on adjusted gross income (agi).

The Current Ctc Provides No Credit For A.

If you're a taxpayer, you will be paying less tax from july.

Last Year, The Average Tax Refund Was $3,167, Or Almost 3% Less Than The Prior Year, According To Irs Statistics.

By comparison, the typical refund check jumped.